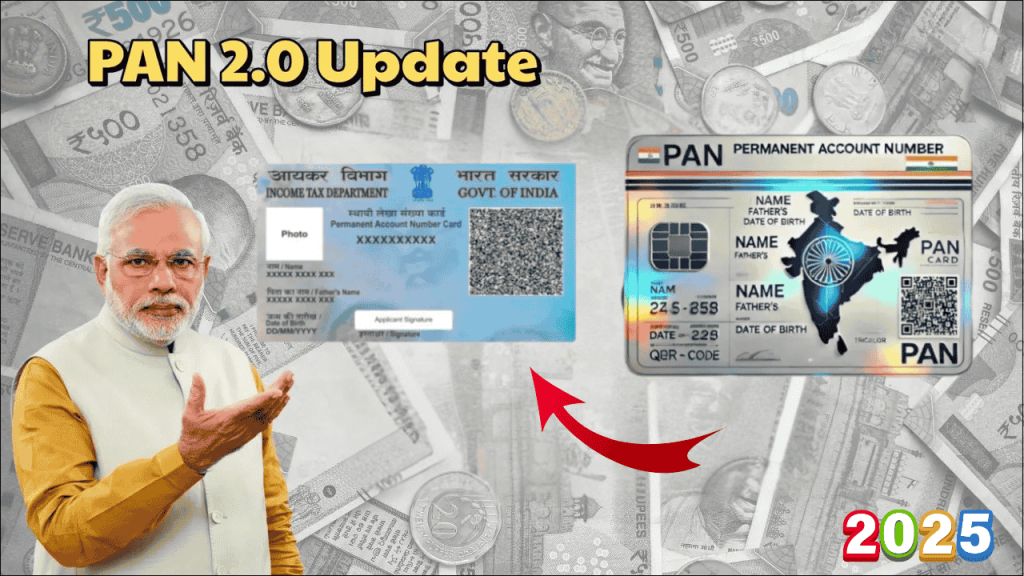

The Indian taxation system is undergoing a revolutionary transformation with the introduction of PAN Card 2.0, a comprehensive upgrade to the existing Permanent Account Number system that promises to modernize taxpayer registration services across the country. Approved by the Cabinet Committee on Economic Affairs (CCEA) on 25th November 2024 with a financial outlay of Rs. 1,435 crore, this ambitious initiative represents a significant leap toward digitalization and enhanced security in India’s financial ecosystem.

The PAN Card 2.0 project aligns perfectly with the government’s Digital India vision, aiming to create a unified, paperless, and technology-driven platform that consolidates all PAN-related services while introducing advanced security features. This modernization effort addresses long-standing challenges in the current system while providing taxpayers with a more seamless and efficient experience in managing their tax-related documentation and compliance requirements.

As India continues its journey toward becoming a digital economy, the PAN Card 2.0 initiative stands as a testament to the government’s commitment to leveraging technology for improved public service delivery, enhanced data security, and streamlined administrative processes.

Table of Contents

Revolutionary Features of PAN Card 2.0

The PAN Card 2.0 system introduces several groundbreaking features designed to enhance security, efficiency, and user experience. The project introduces key advancements, including mandatory Aadhaar linkage, real-time data validation, and advanced analytics to strengthen security and combat fraud effectively.

Enhanced QR Code Technology

In the PAN 2.0 Card, there is an enhanced dynamic QR code. It improves security and provides current information from the PAN database. This upgraded QR code technology represents a significant advancement over previous versions, offering real-time data access and enhanced verification capabilities.

The dynamic QR code ensures that the information displayed is always current and directly sourced from the government database, eliminating the risk of outdated or fraudulent information. This feature enables instant verification of PAN holder details and confirms the card’s authenticity, making it virtually impossible to forge or manipulate.

Unified Digital Platform Integration

A single unified digital platform will consolidate all PAN-related services, enabling easy access to users for managing their accounts. This integration eliminates the confusion and inefficiency associated with multiple platforms, creating a one-stop solution for all PAN-related requirements.

The unified platform will streamline processes that were previously scattered across different portals, reducing processing time and improving user experience significantly. This consolidation also ensures better data consistency and reduces the likelihood of errors or discrepancies in taxpayer information.

Comprehensive Feature Comparison

| Feature | Traditional PAN Card | PAN Card 2.0 | Key Improvements |

|---|---|---|---|

| QR Code | Static QR code (if available) | Dynamic QR code with real-time data | Enhanced security and current information |

| Digital Platform | Multiple portals (NSDL, UTIITSL, e-filing) | Single unified portal | Streamlined access and management |

| Aadhaar Integration | Optional linking | Mandatory linkage | Improved verification and fraud prevention |

| Data Security | Basic encryption | Advanced cybersecurity measures | Enhanced protection against breaches |

| Processing | Paper-based with digital options | Fully paperless system | Eco-friendly and cost-effective |

| Verification | Manual verification processes | Real-time validation | Instant authentication and accuracy |

Significant Benefits and Advantages

The PAN Card 2.0 initiative brings numerous benefits to taxpayers, businesses, and the government administration. The enhanced design helps safeguard identity and financial data while minimizing fraud risks through quick and secure verification.

Enhanced Security and Fraud Prevention

The advanced security features of PAN Card 2.0 significantly reduce the risk of identity theft and financial fraud. Cybersecurity measures will be improved and strengthened to safeguard taxpayer data against unauthorized access and breaches. The mandatory Aadhaar linkage creates an additional layer of verification, making it extremely difficult for fraudsters to create fake identities or manipulate PAN information.

Environmental and Cost Benefits

It aims to reduce environmental impact and promote eco-friendly operations by transitioning to a paperless system, which will result in a cut in operational costs. This environmental consciousness aligns with global sustainability goals while reducing administrative expenses for both the government and taxpayers.

Improved Service Delivery

The unified platform and real-time processing capabilities ensure faster service delivery and reduced waiting times for taxpayers. The project aims to deliver speedy, eco-friendly, and cost-effective taxpayer services with an improved grievance redressal system.

Detailed Benefits Breakdown

| Benefit Category | Specific Advantages | Impact on Users |

|---|---|---|

| Security | Advanced encryption, dynamic QR codes, mandatory Aadhaar linking | Enhanced protection against fraud and identity theft |

| Convenience | Single platform access, 24/7 availability, instant verification | Reduced time and effort for PAN-related services |

| Cost-effectiveness | Free e-PAN delivery, reduced processing costs | Lower financial burden on taxpayers |

| Environmental | Paperless operations, digital document delivery | Contribution to environmental conservation |

| Compliance | Real-time validation, improved data accuracy | Better tax compliance and reduced errors |

Application Process and Requirements

No, existing PAN cardholders are not required to apply for a new PAN under the upgraded system (PAN 2.0). The existing PAN cards will continue to be valid under PAN 2.0. However, taxpayers who wish to upgrade to the new system can do so through a straightforward process.

Step-by-Step Application Process

For taxpayers who choose to upgrade to PAN Card 2.0, the application process has been simplified and digitized. You can apply for a new PAN Card online and receive it on your email ID directly.

The process begins with identifying the issuing agency of your current PAN Card, which can be found on the back of the card. Was it UTI Infrastructure Technology and Services Ltd. (UTIITSL) or the National Securities Depository Ltd. (NSDL)? This information determines which portal you’ll use for the application.

Required Documentation

Proof of identity: Passport, Aadhaar card, voter ID, or any government-issued ID. Proof of address: Utility bills, bank statements, or rental agreements. Proof of date of birth: Birth certificate, passport, or school certificate. Photograph: A recent passport-sized photograph.

Application Process Through Different Portals

| Issuing Agency | Application Portal | Process Steps | Processing Time |

|---|---|---|---|

| NSDL (Protean) | NSDL e-PAN portal | Enter PAN, DOB, Aadhaar details → OTP verification → Payment | 24 hours for e-PAN |

| UTIITSL | UTIITSL portal | Similar process with agency-specific interface | 24 hours for e-PAN |

| Unified Portal (Future) | Single ITD portal | Consolidated process for all services | Enhanced efficiency |

Cost Structure and Delivery Options

Under the PAN 2.0 project, allotment/correction/updation of PAN will be carried out free of cost and e-PAN will be sent to your registered email address. In case you wish to avail a physical PAN card, you need to make a request for the same and pay a prescribed fee of Rs. 50 for delivery of PAN card at an address within India.

This cost structure represents a significant benefit for taxpayers, as the digital version is completely free, while the physical card comes at a nominal cost. In case the PAN card needs to be delivered outside India, you will be required to pay a fee of Rs.15 along with India post charges at actuals.

Service Fees Structure

| Service Type | Cost | Delivery Method | Timeline |

|---|---|---|---|

| e-PAN Card | Free | Email delivery | Within 24 hours |

| Physical PAN (India) | ₹50 | Postal delivery | 15-20 working days |

| Physical PAN (International) | ₹15 + postal charges | International post | As per postal service |

| Corrections/Updates | Free | Digital processing | Real-time updates |

Impact on Business Operations

The PAN Card 2.0 initiative extends beyond individual taxpayers to significantly impact business operations across various sectors. The PAN 2.0 Project modernizes India’s PAN system, making it a unified business identifier across agencies.

Business Compliance and Efficiency

Businesses that are required to have a PAN will experience reduced paperwork as the PAN will serve as a common identifier across government platforms. This will improve coordination with various agencies, including financial institutions and state departments.

This unification eliminates the need for multiple business identifiers and streamlines interactions with various government agencies, reducing administrative burden and improving operational efficiency for businesses of all sizes.

Technology Infrastructure and Security

The PAN Card 2.0 system is built on robust technology infrastructure designed to handle large-scale operations while maintaining the highest security standards. A dedicated vault ensures safe storage for entities using PAN data, bolstering privacy and security.

Advanced Analytics and Fraud Detection

Advanced Data Analytics: Cutting-edge technology helps detect and prevent fraudulent activities more effectively. The system employs sophisticated algorithms to identify patterns and anomalies that might indicate fraudulent activity, providing proactive protection for taxpayers.

Future Prospects and Scalability

The PAN Card 2.0 system is designed with future scalability in mind, ensuring that it can accommodate growing user bases and evolving technological requirements. The unified platform approach provides a foundation for integrating additional services and features as they become available.

Integration with Digital India Initiatives

The PAN Card 2.0 project seamlessly integrates with other Digital India initiatives, creating a comprehensive digital ecosystem for citizens and businesses. This integration enables cross-platform data sharing and verification, reducing redundancy and improving service delivery across government departments.

Support and Assistance

The transition to PAN Card 2.0 is supported by comprehensive customer service infrastructure. Our dedicated customer care team is ready to help! Just give us a call at 020-27218080 any day between 7 am to 11 pm.

This extensive support system ensures that taxpayers can receive assistance throughout the application process and beyond, addressing any concerns or technical issues that may arise during the transition.

Data Migration and Compatibility

Your existing e-PAN will remain valid even after PAN 2.0 project commences. This backward compatibility ensures that existing taxpayers experience a smooth transition without any disruption to their current tax compliance activities.

The system is designed to automatically migrate existing data while maintaining full compatibility with legacy systems, ensuring that no taxpayer information is lost during the upgrade process.

Frequently Asked Questions

Do existing PAN cardholders need to apply for PAN Card 2.0? No, existing PAN cards remain valid, but you can optionally upgrade to benefit from enhanced features and security.

Is there any cost for obtaining PAN Card 2.0? The e-PAN is provided free of charge, while physical cards cost ₹50 for domestic delivery.

How long does it take to receive PAN Card 2.0? The e-PAN is delivered within 24 hours, while physical cards take 15-20 working days for delivery.

Will the old PAN number change with PAN Card 2.0? No, your existing PAN number remains the same; only the card format and features are upgraded.

The PAN Card 2.0 initiative represents a paradigm shift in India’s approach to taxpayer registration and identification services. By combining advanced technology, enhanced security features, and user-centric design, this system positions India at the forefront of digital governance while providing tangible benefits to millions of taxpayers and businesses across the country. As the rollout continues, PAN Card 2.0 will undoubtedly become an integral part of India’s digital infrastructure, supporting the nation’s economic growth and technological advancement.