Bottom Line: Central government employees and pensioners are set to receive a significant 3-4% DA increase from July 2025, raising the current 50% rate to 53-54%, benefiting approximately 48 lakh employees and 68 lakh pensioners.

Table of Contents

Major Relief for Government Workforce

The central government is preparing to announce substantial financial relief through a significant Dearness Allowance (DA) hike that will benefit millions of employees and pensioners across the country. This decision comes at a crucial time when rising inflation and increased cost of living have been impacting household budgets nationwide.

The timing of this announcement aligns perfectly with the government’s bi-annual DA review process, which ensures that employee compensation remains competitive and reflects current economic conditions. This systematic approach demonstrates the government’s commitment to maintaining the purchasing power of its dedicated workforce.

Understanding the DA Calculation

The Dearness Allowance is calculated based on the All India Consumer Price Index for Industrial Workers (CPI-IW), which accurately measures the impact of inflation on essential goods and services. Recent months have witnessed notable increases in retail inflation rates, creating the need for this corresponding DA adjustment.

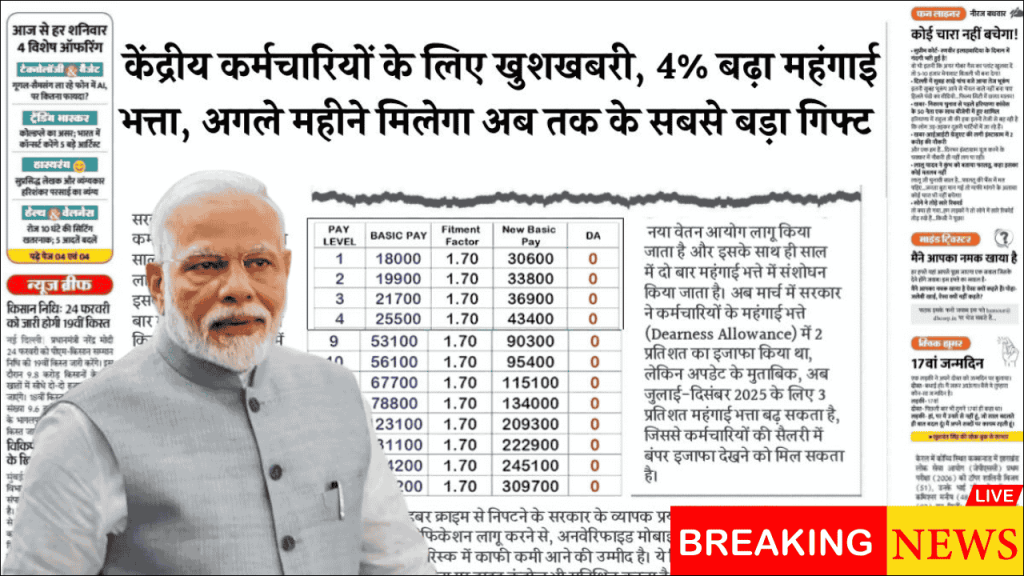

The current DA rate stands at 50% of basic salary, and with the proposed 3-4% increase, it will rise to 53-54%. This follows the established pattern of reviewing DA twice annually in January and July, ensuring regular adjustments to maintain real salary value.

Beneficiary Impact Analysis

The DA hike will create a massive positive impact across the entire central government ecosystem:

Primary Beneficiaries:

- 48 lakh central government employees across various departments

- 68 lakh pensioners including retired servants and dependents

- Defence personnel and paramilitary forces

- Railway employees and postal service workers

- Employees of central public sector undertakings

Financial Impact Breakdown

| Employee Category | Basic Salary | Current DA (50%) | New DA (54%) | Monthly Benefit |

|---|---|---|---|---|

| Entry-Level | ₹20,000 | ₹10,000 | ₹10,800 | ₹800 |

| Mid-Level | ₹40,000 | ₹20,000 | ₹21,600 | ₹1,600 |

| Senior-Level | ₹60,000 | ₹30,000 | ₹32,400 | ₹2,400 |

Detailed Salary Enhancement Examples

For Entry-Level Employees:

- Current total salary: ₹30,000 (₹20,000 basic + ₹10,000 DA)

- New total salary: ₹30,800 (₹20,000 basic + ₹10,800 DA)

- Monthly increase: ₹800

For Mid-Level Employees:

- Current total salary: ₹60,000 (₹40,000 basic + ₹20,000 DA)

- New total salary: ₹61,600 (₹40,000 basic + ₹21,600 DA)

- Monthly increase: ₹1,600

For Senior-Level Employees:

- Current total salary: ₹90,000 (₹60,000 basic + ₹30,000 DA)

- New total salary: ₹92,400 (₹60,000 basic + ₹32,400 DA)

- Monthly increase: ₹2,400

Pension Enhancement Benefits

Pensioners will receive equally significant benefits through Dearness Relief (DR) calculations using the same methodology. For a typical pensioner with ₹15,000 base pension:

| Pension Component | Current Amount | New Amount | Monthly Increase |

|---|---|---|---|

| Base Pension | ₹15,000 | ₹15,000 | – |

| Current DR (50%) | ₹7,500 | – | – |

| New DR (54%) | – | ₹8,100 | ₹600 |

| Total Monthly Pension | ₹22,500 | ₹23,100 | ₹600 |

Implementation Timeline

The government follows a structured implementation process:

July 2025 Schedule:

- Late June 2025: Official announcement expected

- July 1, 2025: Implementation begins

- July 2025: First enhanced salary payment

- Ongoing: Arrears calculation for retroactive periods

Administrative Process:

- Ministry of Finance coordination with all departments

- State government alignment for similar benefits

- Banking system updates for automated calculations

- Employee record verification and updates

Historical Context and Trends

Recent DA increases have followed a consistent pattern:

| Period | DA Rate | Increase |

|---|---|---|

| January 2024 | 46% to 50% | 4% |

| July 2023 | 42% to 46% | 4% |

| January 2023 | 38% to 42% | 4% |

| July 2022 | 34% to 38% | 4% |

This consistent approach reflects the government’s proactive stance in maintaining employee purchasing power amid economic fluctuations.

Economic Impact and Rationale

The DA hike addresses several economic realities:

- Rising fuel and food prices impacting household budgets

- Increased healthcare and education costs

- Housing and transportation expense inflation

- Need to maintain government employee motivation and productivity

The decision will have broader economic implications, creating a multiplier effect through increased consumer spending and enhanced economic activity in government employee-concentrated areas.

State Government Alignment

Historically, state governments follow central DA decisions, potentially extending benefits to over 1 crore employees and pensioners nationwide. While implementation timelines may vary based on individual state fiscal positions, most states are expected to announce similar hikes.

8th Pay Commission Prospects

Alongside the DA announcement, discussions about the 8th Pay Commission have gained momentum, with expectations for implementation from January 2026, including comprehensive salary structure revision and enhanced benefits.

Frequently Asked Questions

Q: When will the new DA rate appear in salary accounts?

A: The enhanced DA will be implemented from July 2025, with the first payment expected in the July salary.

Q: Will state government employees also receive this DA hike?

A: Most state governments typically follow central DA decisions, though timing may vary based on individual state fiscal situations.

Q: How does this DA hike affect other allowances?

A: Yes, it will enhance HRA, PF contributions, and gratuity calculations since many allowances are calculated as a percentage of basic salary plus DA.

Q: Does this benefit apply to all central government employees?

A: Yes, it covers all 48 lakh central government employees and 68 lakh pensioners across various departments and organizations.