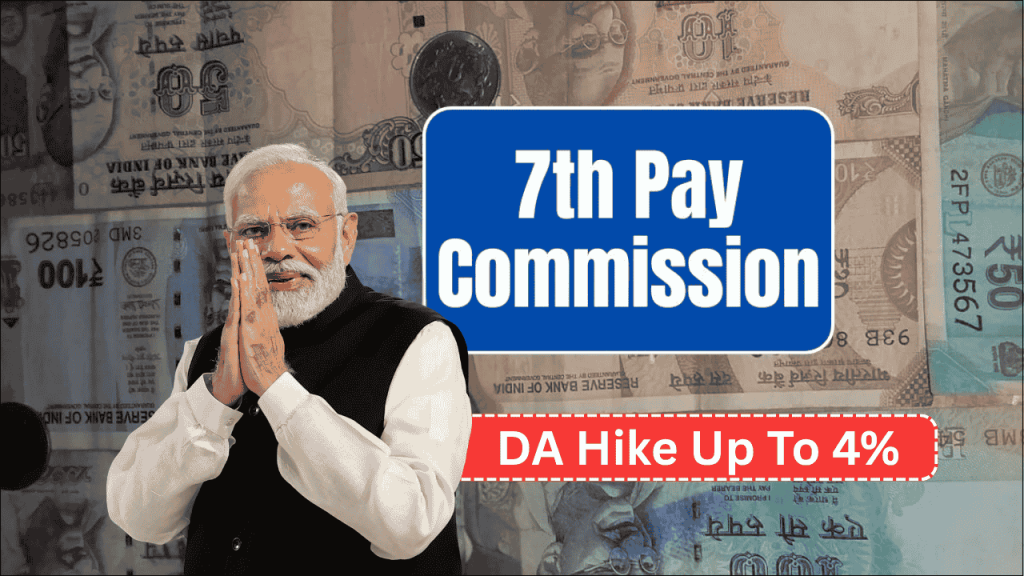

Central government employees and pensioners across India are eagerly awaiting what could be one of the most significant Dearness Allowance (DA) increases in recent years. The anticipated 4% DA hike under the 7th Pay Commission is expected to be announced in July 2025, providing substantial financial relief to millions of government workers.

This potential increase would raise the current DA from 50% to 54% of basic salary, marking a crucial adjustment that addresses rising inflation and living costs across the country. The timing aligns with the government’s bi-annual DA revision schedule, which traditionally occurs in January and July.

What makes this announcement particularly exciting is the expectation that it will be implemented retrospectively from January 1, 2025. This means eligible employees and pensioners would receive significant arrears covering six months alongside their enhanced monthly payments.

Table of Contents

Understanding Dearness Allowance Fundamentals

Dearness Allowance serves as a vital inflation-adjustment mechanism designed to protect government employees’ purchasing power against rising prices. This allowance is calculated as a percentage of basic salary and revised based on All India Consumer Price Index (AICPI) data.

The AICPI reflects changes in the cost of essential commodities and services, including food, housing, transportation, healthcare, and education. When these costs rise significantly, DA increases help maintain employees’ standard of living.

The current DA structure affects not only active central government employees but also extends to pensioners, railway staff, defense personnel, and various other government organizations.

This comprehensive coverage ensures that approximately 1.9 crore employees and pensioners benefit from each DA revision, making it one of the largest single financial benefits distributed by the government.

Expected Financial Impact Analysis

The proposed 4% DA increase will have varying financial impacts depending on individual salary structures and career levels. Higher-grade employees will see larger absolute increases, while the percentage benefit remains consistent across all levels.

For employees with basic salaries between ₹18,000-₹25,000, the monthly increase would range from ₹720-₹1,000. Mid-level employees earning ₹40,000-₹60,000 basic salary could see increases of ₹1,600-₹2,400 monthly.

Senior employees with basic salaries of ₹80,000-₹1,00,000 would benefit from monthly increases of ₹3,200-₹4,000. These amounts, while proportional, represent significant purchasing power enhancement across all levels.

The retrospective implementation from January 2025 means employees would receive six months of arrears, creating substantial lump-sum payments alongside ongoing monthly benefits.

Salary Impact by Grade Levels

| Employee Grade | Basic Salary Range | Current DA (50%) | New DA (54%) | Monthly Increase | 6-Month Arrears |

|---|---|---|---|---|---|

| Entry Level | ₹18,000-₹25,000 | ₹9,000-₹12,500 | ₹9,720-₹13,500 | ₹720-₹1,000 | ₹4,320-₹6,000 |

| Junior Level | ₹25,000-₹40,000 | ₹12,500-₹20,000 | ₹13,500-₹21,600 | ₹1,000-₹1,600 | ₹6,000-₹9,600 |

| Mid Level | ₹40,000-₹60,000 | ₹20,000-₹30,000 | ₹21,600-₹32,400 | ₹1,600-₹2,400 | ₹9,600-₹14,400 |

| Senior Level | ₹60,000-₹80,000 | ₹30,000-₹40,000 | ₹32,400-₹43,200 | ₹2,400-₹3,200 | ₹14,400-₹19,200 |

| Top Level | ₹80,000-₹1,00,000 | ₹40,000-₹50,000 | ₹43,200-₹54,000 | ₹3,200-₹4,000 | ₹19,200-₹24,000 |

Pensioner Benefits and Impact

Central government pensioners will also benefit significantly from this DA revision. The increase applies proportionally to pension amounts, providing crucial support to retired government employees facing inflation pressures.

Minimum pension holders receiving ₹9,000 monthly would see an additional ₹360 per month. Average pension recipients getting ₹15,000 would benefit from ₹600 extra monthly.

Higher pension categories receiving ₹25,000-₹50,000 would see monthly increases ranging from ₹1,000-₹2,000. These amounts provide substantial relief for senior citizens managing fixed incomes.

The retrospective nature means pensioners would also receive arrears, creating immediate financial relief for healthcare, daily expenses, and family support needs.

Economic Indicators Supporting the Increase

The anticipated DA hike is supported by comprehensive economic data showing sustained inflationary pressures across essential commodity categories. Food and beverage prices have increased by 3.2%, while transportation costs have risen by 4.1%.

Housing costs have climbed 2.8%, healthcare expenses are up 3.5%, and education costs have increased by 2.9%. These broad-based price increases justify the need for DA adjustment to maintain real income levels.

The All India Consumer Price Index has shown consistent upward movement over the past six months, with monthly increases ranging from 0.4% to 0.8%. This sustained trend supports the case for a 4% DA revision.

Regional variations in inflation also contribute to the calculation, ensuring that DA adjustments reflect national average price changes rather than localized fluctuations.

AICPI Trend Analysis

| Month | AICPI Points | Monthly Change | Cumulative Impact | Price Pressure Areas |

|---|---|---|---|---|

| January 2025 | 138.2 | +0.8% | Base period | Food, fuel prices |

| February 2025 | 139.1 | +0.6% | Sustained rise | Housing, transport |

| March 2025 | 139.8 | +0.5% | Continued growth | Healthcare, education |

| April 2025 | 140.6 | +0.6% | Persistent trend | Broad-based inflation |

| May 2025 | 141.4 | +0.6% | Stable increase | Service sector costs |

| June 2025 | 142.0 | +0.4% | Moderation but elevated | Core inflation stable |

Implementation Timeline and Process

The DA revision follows a structured administrative process ensuring accurate calculation and timely implementation across all government departments. Data compilation and analysis typically begin in June, followed by calculation and approval phases.

Cabinet approval is expected in mid-July 2025, with official notification shortly thereafter. Payroll system updates across all departments would commence immediately, targeting salary disbursement with arrears in August 2025.

The implementation affects multiple ministries, departments, and organizations simultaneously, requiring coordinated effort from Pay & Accounts Offices nationwide.

Administrative preparation includes updating software systems, training personnel, and coordinating with banks and financial institutions handling government salary accounts.

Beneficiary Coverage Analysis

The DA hike benefits an estimated 1.9 crore individuals across various categories of government service. Central government employees constitute the largest group at approximately 48 lakh, followed by pensioners at 65 lakh.

Railway employees and pensioners together account for 31 lakh beneficiaries, while defense personnel and veterans represent 47 lakh individuals. This comprehensive coverage makes DA revisions one of the most significant welfare measures.

The geographic distribution spans all states and union territories, with higher concentrations in major administrative centers and defense establishments.

Rural and urban employees benefit equally in percentage terms, though absolute amounts vary with salary levels and cost of living differences.

Category-wise Beneficiary Impact

| Beneficiary Category | Estimated Numbers | Average Monthly Benefit | Total Annual Impact |

|---|---|---|---|

| Central Govt Employees | 48 lakh | ₹1,800 | ₹1,03,680 crore |

| Central Govt Pensioners | 65 lakh | ₹900 | ₹70,200 crore |

| Railway Employees | 13 lakh | ₹2,200 | ₹34,320 crore |

| Railway Pensioners | 18 lakh | ₹1,100 | ₹23,760 crore |

| Defense Personnel | 15 lakh | ₹2,500 | ₹45,000 crore |

| Defense Pensioners | 32 lakh | ₹1,200 | ₹46,080 crore |

Fiscal Implications and Economic Impact

The 4% DA increase represents a substantial fiscal commitment by the government, with an estimated annual additional expenditure of ₹55,800 crore. This includes increased salary payments, pension disbursements, and administrative costs.

The economic stimulus effect could contribute 0.2-0.3% to GDP growth as increased disposable income drives consumer spending. Rural and urban markets would both benefit from enhanced purchasing power.

Tax revenue could increase by an estimated ₹8,000 crore annually as higher salaries generate increased income tax collections. This partially offsets the fiscal impact of the DA increase.

The multiplier effect of government spending could amplify the economic impact to 1.5 times the direct expenditure, benefiting various sectors of the economy.

Historical DA Revision Context

Recent DA revisions provide context for understanding the significance of the proposed 4% increase. The January 2024 revision added 3%, raising DA from 47% to 50%.

Previous increases include a 4% hike in July 2023 (43% to 47%) and 3% increases in January 2023 and July 2022. The proposed 4% increase matches the largest recent revision.

This pattern reflects the government’s commitment to regular adjustments based on economic conditions rather than allowing inflation to erode employee purchasing power over extended periods.

The consistency of revisions provides predictability for employee financial planning while maintaining responsiveness to economic changes.

State-wise Economic Distribution

Different regions will experience varying economic impacts based on employee concentrations and local economic conditions. Northern states, with 35% of central government employees, will see the highest absolute impact.

Western states, housing 25% of employees with higher average salaries, will generate significant urban economic stimulus. Southern states’ 20% share includes substantial technology sector spillover effects.

Eastern and central states, with smaller employee concentrations, will still benefit from enhanced rural economy support and agricultural region stimulus.

Regional multiplier effects will vary based on local economic structures, but all areas will experience positive impacts from increased government employee spending.

Future Outlook and 8th Pay Commission

While the 4% DA hike provides immediate relief, attention is also focusing on the potential 8th Pay Commission. This commission could bring more comprehensive salary structure reforms beyond regular DA adjustments.

The 8th Pay Commission constitution is expected in late 2025 or early 2026, with report submission anticipated in 2027-2028. Implementation could occur around 2029-2030, providing major salary and pension revisions.

Until then, regular DA revisions will continue providing cost-of-living adjustments based on AICPI trends and inflation patterns.

The combination of immediate DA relief and future Pay Commission prospects creates a positive outlook for government employee welfare over the coming years.

Administrative Preparation and Challenges

Implementing DA revisions across 1.9 crore beneficiaries requires extensive administrative coordination. Payroll systems must be updated simultaneously across thousands of offices nationwide.

Bank coordination ensures smooth salary credit processes, while pension disbursement systems require parallel updates. Training programs help administrative staff manage the transition effectively.

Technology infrastructure must handle increased processing loads during arrears calculations and disbursements. Backup systems ensure continuity during implementation phases.

Quality control measures verify accurate calculations and prevent errors that could affect employee payments or create administrative complications.

Quick FAQs

Q: When will the 4% DA hike be officially announced?

A: The announcement is expected in July 2025, with implementation likely in August 2025.

Q: Will the increase apply retrospectively from January 2025?

A: Yes, employees and pensioners will receive 6 months of arrears from January 1, 2025.

Q: How much extra money will I get monthly with this DA hike?

A: Monthly increases range from ₹720-₹4,000 depending on your basic salary level.

Q: Do all central government pensioners benefit from this DA increase?

A: Yes, all central government pensioners receive the same percentage DA increase as active employees.